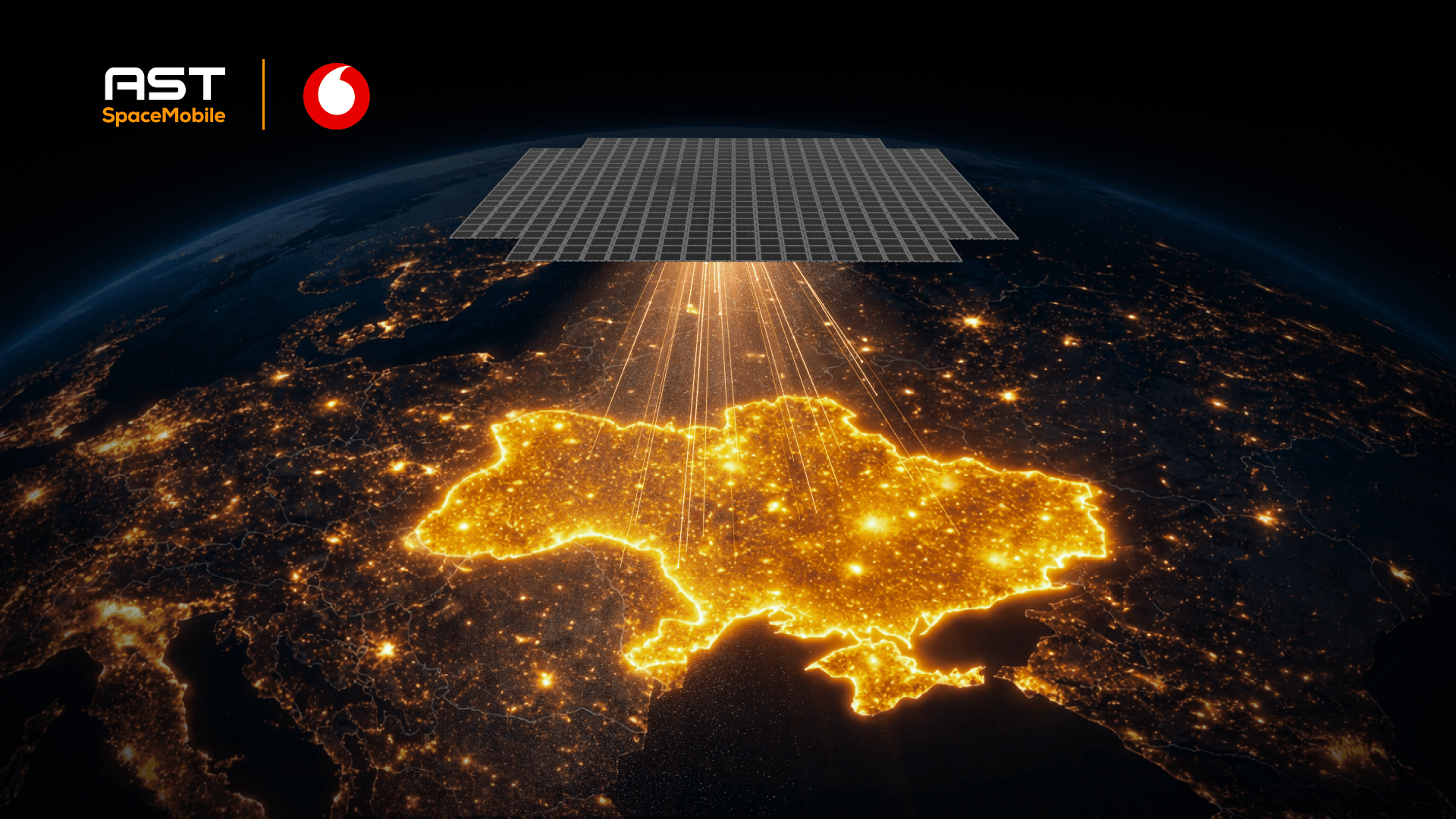

Vodafone Україна і AST SpaceMobile готуються до запуску супутникового зв’язку

Vodafone Україна та AST SpaceMobile готують підґрунтя для переходу до повноцінного супутникового інтернету та голосу в Україні

2 березня 2026Tech-новини

Детальніше

Vodafone Україна: перші результати роботи «Роумінг як вдома» – понад 900 тисяч користувачів за січень 2026 року

Vodafone Україна продовжує інтеграцію до єдиного роумінгового простору Європейського Союзу та підбиває перші підсумки роботи послуги «Роумінг як вдома».

18 лютого 2026Тарифи, акції та сервіс

Детальніше

Перше 5G-весілля в Україні: Vodafone запустив тестування 5G у Харкові в День закоханих

14 лютого 2026 року Vodafone розпочав відкрите тестування 5G у Харкові. Символічно, що саме цього дня перша пара в Україні зареєструвала шлюб онлайн через сервіс Дія, використовуючи 5G мережу Vodafone.

17 лютого 2026Тарифи, акції та сервіс

Детальніше

Vodafone запустив відкрите тестування 5G у Бородянці

28 січня Vodafone розпочав відрите тестування 5G у селищі Бородянка Київської області.

28 січня 2026Tech-новини

Детальніше

Vodafone визнано лідером з якості фіксованого інтернету в Україні

Vodafone очолив рейтинг фіксованого інтернету в Україні за підсумками 2025 року за даними незалежної компанії nPerf.

14 січня 2026Бізнес та інвестиції

Детальніше

Vodafone запустив масштабне відкрите тестування 5G

12 січня в Україні стартувало масштабне відкрите тестування 5G.

13 січня 2026Tech-новини

Детальніше

Перші 12 годин роботи 5G у Львові

Понад 1ТБ даних і швидкість >1,4 Гбіт/с

13 січня 2026Tech-новини

Детальніше

До уваги абонентів тарифів лінійки FLEXX

Ми продовжуємо інвестувати кошти в підтримку, відновлення та розбудову мережі. Інвестиції Vodafone в Україні протягом повномасштабної війни перевищили 20 мільярдів гривень, з яких понад 2 млрд грн – у підвищення енергостійкості мережі. Через ситуацію в енергетиці ці витрати зростають.

5 січня 2026Тарифи, акції та сервіс

Детальніше

Vodafone впроваджує принцип «Роумінг як вдома» у контрактних та бізнес тарифах

Vodafone Україна продовжує масштабне оновлення тарифної лінійки у межах інтеграції України у єдиний роумінговий простір Європейського Союзу.

23 грудня 2025Тарифи, акції та сервіс

Детальніше